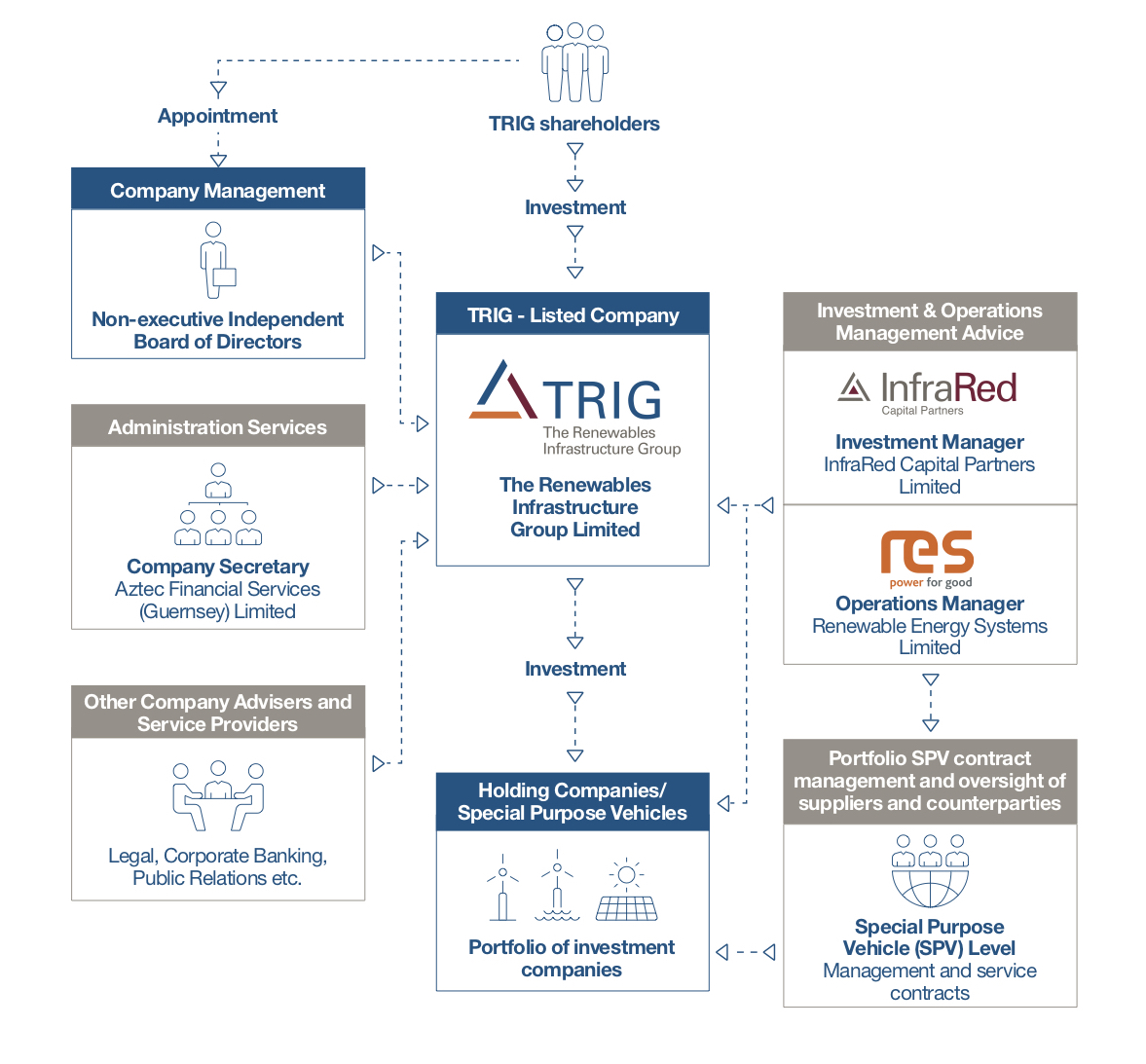

Business model and investment policy

TRIG's Business Model

TRIG seeks to enhance the long-term sustainability of shareholder returns through:

- Portfolio diversification

- Responsible investment

- Value enhancement

To find out more about the interaction between these core elements, click the segments through to the business model page.

Our Investment Policy

Our objectives

FAQs

- What are the features of the renewables market opportunity?

- How does TRIG set its business strategy?

- What are TRIG's investment risks?

- How does TRIG make new investments?

- How does TRIG construct its portfolio?

- What are TRIG’s key investment requirements and investment limits?

- What is TRIG’s approach to gearing?

- How does TRIG invest in renewable energy?

- How does TRIG invest in the energy transition?

- What are TRIG’s return targets?